Nifty -Wide Range expected 21800 -22650-22800; Awaiting Election Outcome; VIX Spiking Continuously;

- Neeraj Bhatia

- May 20, 2024

- 7 min read

The Nifty index closed the week at 22,502, while the Bank Nifty climbed by 1.68 percent to end at 48,199.50. Nifty Midcap hit an all-time high at 11,347 and posted the biggest weekly gain in eight months and Nifty's small-cap closed the week at 17,009 level. Nifty Realty and Nifty Metal hit a record high this week gaining seven percent each. Nifty FMCG was the only sectoral indices that closed in red.

As the high-stakes Lok Sabha election results approach closer, the volatility in the stock market is weighing on investor's sentiments, both domestically and across borders. Foreign outflow from Indian equities continues unabated amid the rising India VIX index and uncertainty of the election outcome.

Post Market Weekly Analysis

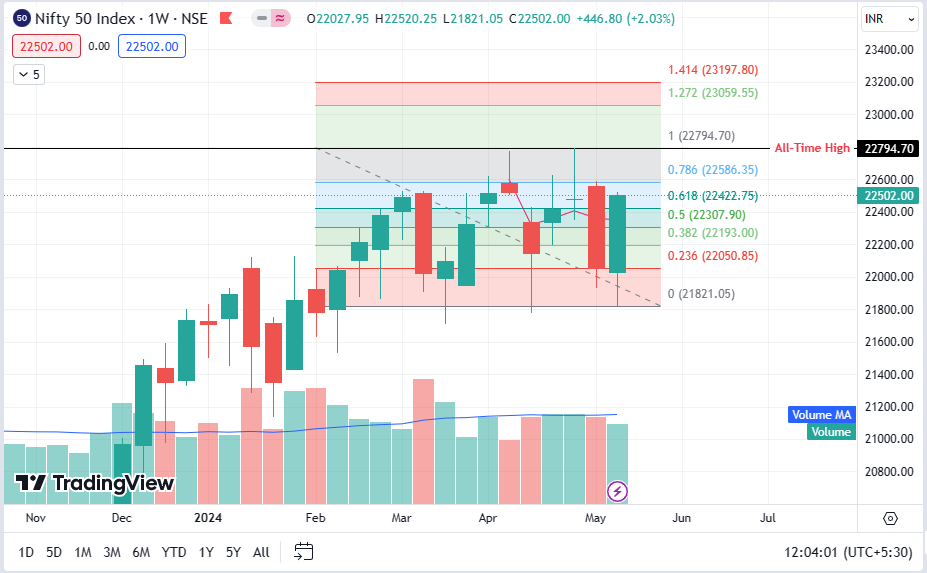

The Nifty 50 weekly Index opened at 22027.95 touched the high level of 22520.25 and slipped down to 21821.05 before closing at 22502.. So the benchmark index oscillated in a range of 699.20 points over the previous week's trading sessions, finally closing on a gain of 446.80 points, i.e. in percentage term (2.03%) on a week-on-week basis.

Nifty 50 Index Monthly Chart

The monthly chart got rejected from all all-time highs and still was not able to cross the 22800 mark. The election results in the coming days can decide the trend for May month. to approach the 23000 level, the Nifty index needs to cross 22800 decisively. The support is still intact on 21800 levels.

Nifty 50 Index Weekly Chart

From the lowest level of the week i.e. 21821, the Nifty 50 Index bounces up to 22500, which is a remarkable comeback. going forward once again we have a large range of support from 21800 to 22500 levels. We can see a pullback if the index can cross 22500 levels, it will move towards 22800, followed by 22990 levels.

Nifty 50 Index Daily Chart

In the last seven days, the market has been made higher lows, which gives confidence in bulls to cross the 23000 level, this time. Due to increased volatility, either side is not confident to move one way, either bullish or bearish. 22500 levels have seen maximum option interest build up on both sides. We need to wait for either side to break out on Tuesday trading.

Nifty 50 Weekly Fibonacci Chart Status

We are expecting a wide-range bound market with volatility in the coming week. So we are expecting Fibonacci levels will be within in derived range only.

Nifty 50 Index Weekly Chart -with Technical Indicators

RSI Indicator Pattern

The weekly RSI is at 62.67; it has extended the formation of a new 14-period low which is bearish. It also shows a bearish divergence against the price.

Money Flow Indicator

This weekly indicator is at 67.24 which suggests bearish signals.

MACD Indicator Pattern

The weekly MACD is bearish and trades below the signal line. The squeezing of the widened Histogram indicates the selling can be stopped this week. It stays neutral.

FII's & DIIs Cash Weekly/Monthly Activities

Foreign institutional investors (FIIs) are on a selling spree and were sellers for five out of six sessions last week with the total outflow from Indian equities recorded at ₹10,649.92 crore. Domestic institutional investors (DIIs) were net buyers for five out of six sessions, with a total investment of ₹14,410.18 crore, according to stock exchange data.

According to market analysts, the main trigger for the FII selling has been the outperformance of the Kong Kong index Hang Seng which shot up by 19.33 percent during the last month.

FIIs are moving money from expensive markets like India to cheap markets like Hong Kong where the PE is around 10 compared to around 20 PE in India.

Foreign portfolio investors (FPIs) have turned aggressive sellers in Indian markets due to high market valuation, uncertainty over the outcome of the Lok Sabha elections 2024, rise in the volatility index--India VIX and high US bond yields.

The situation can change dramatically when clarity emerges on the election outcome. Going forward, there is likely to be a dramatic change in FPI equity flows in response to election results. Political stability will attract huge inflows,

Outlook for the NIFTY 50 Index for the Coming Week

In the fourth week of May, investors will keenly eye the ongoing January-March quarter results for fiscal 2023-24 (Q4FY24), voter turnout, domestic and global macroeconomic data, foreign fund outflows, crude oil prices, and global cues.

Domestic equity benchmarks traded firmly, drawing strength from lower levels as investors aligned with the broader bullish market outlook. Nifty 50 reclaimed back 22,500 level and the Sensex closed the week above the 74,000 level

Initially, the market experienced some volatility due to a significant increase in the India VIX, which rose by more than 11.11 percent, and concerns over low voter turnout in the ongoing general elections, which heightened fears of an unstable government at the center. However, market sentiment improved following comments from key government officials.

India VIX:

The previous week had seen VIX spiking up by 0.7275%. This week as well, over the past week's sessions, the VIX has surged another 11.11% to 20.52

Support Level for the Coming Week for NIFTY:

The broader support level on the technical chart could be 22000, followed by 21780 levels.

Resistance Level for the Coming Week for NIFTY:

The broader resistance level on the technical chart could be the level of 22650, followed by 22790 levels.

Important Upcoming Monthly/Weekly Activities

Q4 Results, US Fed chair Speech

Domestically, the last major batch of Q4 earnings reports will drive stock-specific movements.

US Federal Reserve Chairman Jerome Powell is scheduled to deliver a speech on Monday, May 20, 2024, which is expected to further influence market sentiments. Last week, Powell tested positive for COVID-19 and is currently working from home, a US Fed spokesperson said in an emailed statement.

Global Cues

Global markets are currently in a buoyant mood, driven by positive global cues such as cooling US inflation, which raises hopes for potential rate cuts by the Federal Reserve, and strong earnings from tech stocks. The Dow Jones has climbed 1.24 percent, reaching the 40,000 mark for the first time, while the Nasdaq has risen 2.12 percent in the third week of May 2024.

The outlook for the market will be guided by the major global economic data. UK inflation data, US initial jobless claims, US bond yields, China loan prime rate, S&P global services data, and S&P global manufacturing PMI and quarterly results will be among the key triggers in global markets.

US Fed chair Powell's comments are likely to bring market movement. The cooling off of US 10-year bond yields and the dollar index is further strengthening the market

Crude Oil

International crude oil prices gathered steam and settled nearly one percent higher in the previous session, with global benchmark Brent crude recording its first weekly gain in three weeks. The rebound in prices came after bullish macroeconomic data indicators from the world's top two oil consumers - China and the US - bolstered hopes for higher oil demand.

Brent settled 71 cents higher, or 0.9 percent, at $83.98 a barrel. US West Texas Intermediate crude (WTI) gained 83 cents, or 1.1 percent, to $80.06. For the week, Brent gained about one percent, while WTI rose two percent, according to news agency Reuters. The International Energy Agency (IEA) trimmed its global oil demand forecast for 2024, widening the gap with the producer group Organization of Petroleum Exporting Countries (OPEC).

Technical Analysis

For Nifty 50, we anticipates some profit booking around the 22,650 level, as this retracement level is often considered significant in technical analysis, indicating a potential resistance zone.

’However, any resultant profit booking from 22650 could be viewed as an opportunity to initiate new long positions near 22200, suggesting a bullish outlook beyond this retracement level.

On the downside, the zone between 22,200 and 22,000 is identified as a crucial support level for the upcoming sessions

Reading Current Option Data

Options data indicated that 23,000 is expected to be the key resistance area for the Nifty 50 in the coming week, with key support at 22,000 levels.

On the weekly options front, the maximum Call open interest was seen at 23,000 strikes, followed by 22,800 and 22,650 strikes, with maximum Call writing at 23,000 strikes, then 22,800 and 22,500 strikes. On the Put side, the 22,000 strikes saw the maximum open interest, followed by 22,400 and 22,500 strikes, with the maximum writing at 22000 strikes, then 224,00 and 22,500 strikes.

Participant Wise Final F&O Weekly Summary

FII's, PRO, and Clients F&O Summary by Segment

1). FII's positions as of the last trading day:

2). PRO's position as of the last trading day:

3). CLIENT's position as of the last trading day:

Summary - Overall

In the fourth week of May, investors will keenly eye the ongoing January-March quarter results for fiscal 2023-24 (Q4FY24), voter turnout, domestic and global macroeconomic data, foreign fund outflows, crude oil prices, and global cues.

Domestic equity benchmarks traded firmly, drawing strength from lower levels as investors aligned with the broader bullish market outlook.

Investors are expressing optimism regarding potential interest rate cuts in 2024, supported by favorable US consumer inflation data and improved jobless claims figures, which have also contributed to a surge in gold prices and strengthened the stock market rally. Uncertainties persist regarding the timing of US Fed rate adjustments...Amidst ongoing uncertainties surrounding election results and quarterly earnings, we anticipate continued volatility in the near term

Overall, the markets will continue to portray a tentative mood. It may show technical rebounds from current levels; however, these rebounds, if at all they occur, are likely to stay capped to their extent.

The markets continue to stay vulnerable to profit-taking bouts at higher levels.

It is strongly recommended that one must stay highly selective while making fresh purchases; it is also expected that the markets may turn a bit defensive as well. While keeping leveraged exposures at modest levels and vigilantly protecting profits, a highly cautious approach is advised for the coming week.

Thanks for reading.

Keep Trading

Stay Invested

Regards,

Neeraj Bhatia

(Managing Director)

Disclaimer: I am a National Stock Exchange-certified Technical Analyst and Chartist but not a SEBI-registered analyst, so consult your financial advisor before taking any trade. This technical weekly post-market journal is only for learning purposes and it is downloadable free of cost. The views written here are entirely only my personal views. I am not forcing anyone to follow my thoughts. I do not have any WhatsApp Group ID or Telegram ID related to it.

Comments