Nifty - Use Every Technical bounce to book profit; Volatile Week Ahead; Wide Range 21610 to 22380

- Neeraj Bhatia

- Mar 24, 2024

- 8 min read

The previous week, the market rebounded to close higher in the week ended March 22 on the back of a smart recovery in the second half amid a dovish Fed policy and strong buying by domestic institutions. The recovery in Indian markets dared a selling spree of foreign institutional investors (FIIs).

The market was cautious in the first half of the week ahead of the FOMC meet outcome, but the mood turned in favor of bulls after the US Federal Reserve raised the economic growth forecast for CY24 to 2.1 percent from 1.4 percent earlier, and maintained interest rates in 5.25-5.5 percent range, indicating three rate cuts this calendar year despite inflation above its long-term target of 2 percent.

Post Market Weekly Analysis

The Nifty 50 weekly Index opened at 21990.10 touched the high level of 22180.70 and slipped down to 21710.20 before closing at 22096.75. So the benchmark index oscillated in a range of 470 points over the previous week's trading sessions, finally closing with a gain of 73.40 points, i.e. in percentage term (0.33%) on a week-on-week basis.

Nifty 50 Index Monthly Chart

On the monthly chart, it is visible that from a long-term perspective, investors are still bullish. After a pause with the Dozi candle in January 2024, where the index lost only 5.70 points, once again participants are bullish the index gained 257 points in February month and now we have gained 113 points so far in March month. We are moving forward at a snail's pace but, we are increasing in continuous channels..

Nifty 50 Index Weekly Chart

On the Weekly Chart, the Nifty 50 Index is getting support from 9-week SMA and 20-week SMA, which is good for short-term bullish trading terms. along with weekly volumes are good enough to give support in lower India VIX

Nifty 50 Index Weekly Chart (Extended)

On the Weekly chart, Nifty trying to enter back into the same channel, that it had left in the previous week, but we can see the immediate resistance is the 22300 level, if this level crosses above decisively with good volume, this will take Nifty 50 index at least the middle of the channel, which is sitting at 22888 levels as of now.

Nifty 50 Index Daily Chart

After hitting a lower level of 21710, the Nifty 50 Index regained the 22000 level, which is good for short-term bullish trend. If the Nifty 50 index can sustain and close above 22200 levels, then immediately it can regain the level of 22300. Above this level, the only hurdle will be 22500, which is a physiological number, crossing which the levels of 22700-22800 range can not be ruled out in the near future, not in the coming week.

The only concern is that in the last trading session, Nifty got rejected from 22180 levels, and closed below 22100, this makes sentiment weak and could force range-bound monthly expiry.

Nifty 50 Weekly Fibonacci Chart Status

The immediate support of 21700 has been tested and rejected from lower levels. For the coming week, we are expecting range-bound expiry with volatile moves, so the broad range would be 21500 to 22500 only. The Fibonacci level of 0.236 would be very important to be watched out for.

Nifty 50 Index Weekly Chart -with Technical Indicators

RSI Indicator Pattern

The weekly RSI stands at 65.62; it stays neutral and does not show any divergence. However, when subjected to pattern analysis, it shows a negative divergence against the price.

MoneyFlow Indicator

This weekly indicator is at 67.53 which is compatible with the RSI indicator pattern. The pattern of negative divergence can play its role.

MACD Indicator Pattern

The weekly MACD has shown a negative crossover; it is now bearish and trades below its signal line.

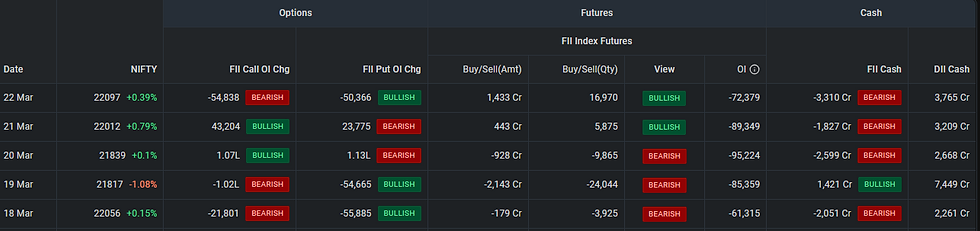

FII's & DIIs Cash Weekly and Monthly Activities

The inflow from foreign institutional investors remained subdued in the passing week, which capped the major market upside, but having consistent big buying by domestic institutional investors lifted the market mood and has been providing great support to the market. Hence, the street will focus on both flows going forward.

FIIs have net sold Rs 8,365.53 crore worth of equity shares during the week ended March 22, but DIIs significantly compensated for the FII outflow, buying 19,351.62 crore worth of shares during the same period.

DII's monthly buying in March at Rs 47,398 crore was the highest since May 2022, while FII's net inflow in the current month stood at Rs 946 crore.

Outlook for the NIFTY 50 Index for the Coming Week

In the truncated week ahead, the market is expected to be rangebound and volatile given the monthly derivative contract's expiry, and the volume may be a bit low due to a couple of holidays.

Nothing much should be expected from the coming week; the markets are likely to stay in a defined range with no tangible upsides visible beyond a few technical rebounds.

Importantly, we have monthly derivatives expiry lined up. Also, on top of it, we have just a 3-day trading week. Monday is a trading holiday on account of the Holi festival and Friday is a trading holiday on account of Good Friday.

The monthly derivatives expiry and the short trading week may not support the markets for any kind of runaway up move taking place. The previous week’s high point is likely to act as resistance over the coming days; by and large, besides any intermittent technical rebounds, we are unlikely to see any runaway kind of upmove taking place.

India VIX:

The previous week India VIX closed at 13.69 it touched a high of 14.6150 and a low level of 11.81

India VIX, the fear gauge, fell 10.74 percent during the week to 12.22, the lowest level since November 20-24 (2023) week.

The sharp fall in volatility also caused strength in the market. if it sustains at current levels, then that may give some more comfort for bulls going ahead.

Support Level for the Coming Week for NIFTY:

The broader support level on the technical chart could be 21700, followed by 21610 levels.

Resistance Level for the Coming Week for NIFTY:

The broader resistance level on the technical chart could be the level of 22200, followed by 22380 levels.

Crude Oil

The cooling down in oil prices in later half of the week amid hopes of easing geopolitical tensions also supported the Indian equities a bit, but Brent crude futures, the international oil benchmark, still traded above all key moving averages and downward-sloping resistance trendlines on the weekly basis.

Overall, we remain bullish on the oil prices in the short to medium especially after the dovish Fed policy, though there was a profit booking during the week passing by.

Brent crude futures during the week reached the highest level since November 2023, but finally ended 0.6 percent down for the week at $84.83 a barrel after US Secretary of State Antony Blinken expressed optimism regarding talks in Qatar aimed at reaching a Gaza ceasefire agreement between Israel and Hamas.

Important Upcoming Weekly Activities

US GDP

Globally, investors will keep an eye on the quarterly US GDP (gross domestic product) final data due on March 28. As per the second estimate, the US economy grew 3.2 percent in the October-December quarter of the year 2023 (against advance estimates of 3.3 percent), against 4.9 percent growth in the previous quarter, and as a result, full year (2023) growth comes at 2.5 percent, compared to 1.9 percent in the previous year. The speech by the Federal Reserve Chair Jerome Powell on March 29 will also be watched and the focus area will be the timing of rate cuts and inflation outlook.

Global Economic Data

Apart from GDP numbers, the participants will also focus on new home sales, durable goods orders, jobs data, PCE prices, and personal income & spending data from the US next week.

In addition, the Bank of Japan's monetary policy meeting minutes, UK GDP numbers for Q4-2023, and China's current account data for Q4-2023 will also be watched.

Domestic Economic Data

On the domestic front, the street will focus on current account and external debt numbers for Q3FY24 which is scheduled to be released on March 28.

Further, fiscal deficit and infrastructure output data for February, and foreign exchange reserves for the week ended March 22 will be released on March 29.

Technical Analysis

Technically, the Nifty 50 may remain rangebound unless it decisively breaks 22,200 on the higher side, with immediate support at 21,950 and key support at 21,700 level.

The index has formed a bullish candlestick pattern with a long lower shadow on the weekly scale, indicating buying interest at lower levels, after a long bear candle in the previous week, but still consistently holding a 10-week EMA (21,950) on the

closing basis.

As long as the support level of 21,700 holds, a buy-on-dips stance is advisable. However, a breach of 21,700 could potentially lead the index towards the 21,600 – 21,500 range.

On the upside, the levels of 22,200 – 22,450 are anticipated to pose strong resistance in the coming week, he feels.

Reading Current Option Data

In the coming week, the market is expected to be volatile given the monthly F&O expiry scheduled on March 28. The monthly options data indicated that 21,900-21,800 is expected to be a support area for the Nifty 50, with a hurdle on the higher side at 22,100-22,300 zone, followed by the 22,500 mark.

On the Call side, the maximum open interest was seen at 23,000 strikes, followed by 22,500, 22,700, and 22,000 strikes, with meaningful writing at 22,500 strikes, then 22,600 & 23,000 strikes.

On the Put side, 22,000 strikes owned the maximum open interest, followed by 22,100 & 21,500 strikes, with writing at 22,100 strikes, then 22,000 & 21,900 strikes.

Participant Wise Final F&O Weekly Summary

FII's, PRO, and Clients F&O Summary by Segment

1). FII's positions as of the last trading day:

3). PRO's position as of the last trading day:

3). CLIENT's position as of the last trading day:

Summary - Overall

The pattern analysis shows that the last phase of the up move that the Nifty had has come with a negative divergence of the RSI against the price. While the price marked higher highs, the RSI did not and this led to the negative divergence.

In the process, the Nifty has also formed an intermediate high at 22525 levels. The nearest support exists in the form of a 20-week MA which currently stands at 21407. This may keep the markets under corrective pressure; no significant upmove can be expected and the corrective undertone may continue to persist for some time.

Overall, we are likely to see banking and finance space trying to improve their relative performance.

Besides this, the defensive pockets like IT, Pharma, FMCG, etc., may see some resilient show as they try to improve their relative strength against the broader markets.

It should be noted that all upmove or technical rebounds are likely to nd selling pressure at higher levels.

It is strongly recommended to use all technical rebounds as and when they occur to protect profits at higher levels. While continuing to stay highly selective in approach, a cautious outlook is advised for the coming week.

Thanks for reading.

Keep Trading

Stay Invested

Regards,

Neeraj Bhatia

(Managing Director)

Disclaimer: I am a National Stock Exchange-certified Technical Analyst and Chartist but not a SEBI-registered analyst, so consult your financial advisor before taking any trade. This technical weekly post-market journal is only for learning purposes and it is downloadable free of cost. The views written here are entirely only my personal views. I am not forcing anyone to follow my thoughts. I do not have any WhatsApp Group ID or Telegram ID related to it.

Comments